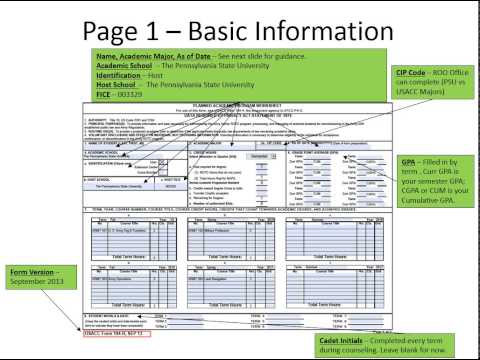

This presentation will explain one technique to prepare a plan to satisfy your Penn State degree requirements. - It will then explain how to fill out a U.S. ACC form 1:04, also known as the 104 AR. - Students attending other colleges may be able to use this technique using their school's resources, unless otherwise noted. - These instructions apply to students attending the University Park campus. - To complete the United States Army Cadet Command form 1:04, you will need certain items. - It is recommended that you contact the recruiting operations office to get a copy of the 104 AR that has some Penn State specific information already filled in. - However, this presentation will assume that you have a blank 104 AR. - You must use the PDF version of the 104 AR data from September 2013 or later. - Earlier versions use an Excel file that does not calculate the credit hours in the same way. - Only use the current PDF version. - You will also need to access the university bulletin at the URL shown on the screen. - The presentation will later show how to access your particular Penn State recommended academic plan. - The 104 AR is a three-page document. - The first page includes your ministry of data and the first part of your academic plan. - This example includes the common information used by all cadets attending Penn State Army ROTC, with the dates for those who will graduate in May of 2019. - The second page has the remainder of your academic plan and a certification section. - The last page is a statement of understanding between you and the professor of military science, stating that you will complete the requirements for a particular degree. - The Penn State...

Award-winning PDF software

1041 k-1 Form: What You Should Know

How Do You Choose the Correct Line on Form 1041? How Do You Choose the Right Line on IRS Form 1040 (or Form 1040NR)? Income earned from a business isn't included as income on your income tax return. Income that is used exclusively for home-related expenses is included as income on your tax return instead. Example of Earned Income is excluded from the calculation of your adjusted gross income. As a rule of thumb, if you spend more than 60 percent of your total household income on home-related expenses, you are a homeowner. To determine how much of the total household income is spent on home expenses, follow the rules in IRS Publication 970, Residential Mortgage Interest Deduction, and the examples in IRS Publication 970-A, Mortgage Interest Deduction, and Form 8821, Mortgage Interest Statement. Example: John is a single person living in Illinois. He meets the annual requirements for filing a sole proprietorship in Illinois, as well as the filing requirements by filing a joint return with his wife, who has three children. His gross income is 60,000. John is not eligible for any refundable credits which may be available through the Earned Income Tax Credit (ETC); therefore, he will not receive any refundable credit for the amount of his income that is used exclusively to pay property taxes for his home. In calculating his income, John spends 50% on tax-exempt interest on his mortgage, tax-exempt interest on his car insurance premiums, property taxes on his home, insurance premiums on both his car and home, food expenses, and personal expenses. He spends the remaining 50% of his income on his home; that is, he would spend 30,000 on property taxes and 20,000 on insurance (the remainder would be for food, entertainment, and transportation). John's gross income is 10,000 (the remaining 90 is property taxes). John is a full-time student, and he would be eligible for the student loan interest deduction and the education, training, and library tax credits available through the Education Credit. He would be eligible for the ETC and the education credit, assuming he was married and the income of his spouse was not included in the calculation of his gross income because of the joint filing status. John would receive a 2,500 exemption for tuition and fees (120) and for student loan interest (160), and 4,000 for both student loan interest and student loan income (320).

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1041, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1041 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1041 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1041 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1041 k-1